Profarma Group's d1000 feed IPO keeps pharmaceutical strong

By Daniel Christian Henrique

The year 2020 promised to be the year of the IPO (Initial Public Offering) at B3, but restrained by the pandemic. Resuming the B3 scoring level, another retailer stands out in high prices, the pharmaceutical Profarma (PFRM3). Its biggest differential for growth in the last few weeks on the stock exchange, however, was the filing on July 8 of an IPO of its subsidiary d1000 Varejo Farma Participações, with an approximate value of R $ 400 million. The company owns the retail brands Farmalife, Drogarias Tamoio and Drogasmil.

As can be seen in the chart below, since one month before filing, exactly on June 9th, the 21-day moving average (in yellow) of PRFM3 quotes crosses its 42-day moving average from bottom to top (in green) ), indicating a reversal of the upward trend, leaving its almost lateral movement and forming an upward channel, confirmed by an increase in the volume of trading and re-entry in the overbought region of the Relative Strength Index (IFR). On the day of the IPO filing, July 8, there is a new strong increase, again confirmed by the volume and region of the overbought. Finally, on July 17, the board of directors confirms the realization of the d1000 IPO, generating a jump of 10.3% in the morning in the Profarma papers, bursting the channel and doubling its trading volume. After the moment, the quotes re-enter the channel and the IFR returns to the region of the oversold.

Source: Economatica (2020)

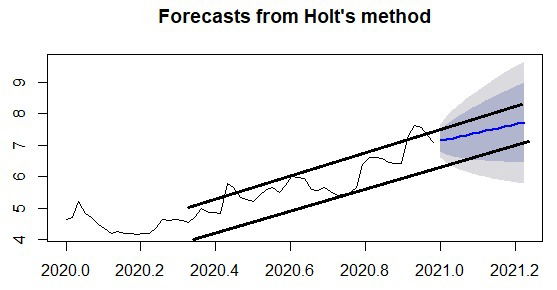

Taking as a reference a projection by Holt's exponential technique for the next two weeks, it can be noted that the quotations forecasts remain within the channel formed, however exceeding them in their confidence levels of 80% and 95%.

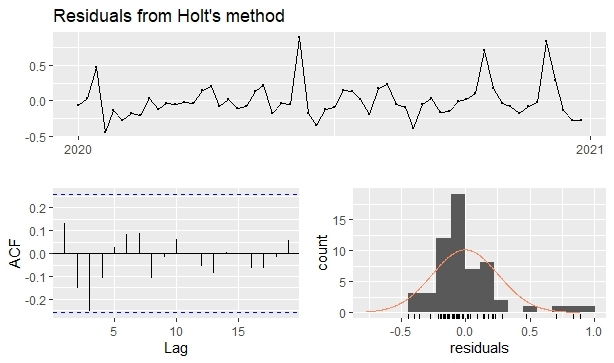

As for the predicted values, its accuracy can still be denoted by obtaining a p-value equal to 0.2847 in the Ljung-Box test, as well as observing the existence of random residues, confirmed by the ACF graphs. The moment, however, needs constant monitoring of the movements of its values, since investors may be overconfident (Overconfidence Effect), as a result of the recent valuations of prices accompanied by increases in trading volumes.

Reference

ECONOMATICA. Plataforma Economatica. Available in: https://economatica.com.Access in: 23 jul. 2020.