Finance & Market Bulletin - October 2021

By Daniel Christian Henrique

The main variations in the indices that move and influence the capital markets for the month of October were:

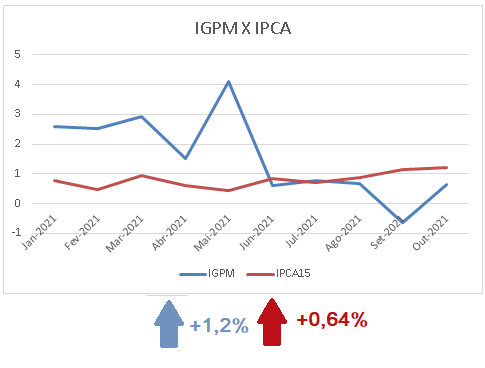

Inflation Rates:

Source: Economatica (2021)

After suffering a setback in the previous month, the IGPM once again increased by 0.64%, resulting in an accumulated increase of 16% in the year. Iron ore was the main item linked to its high this October (FGV, 2021).

The IPCA-15, in turn, suffers the biggest monthly increase since October 2015, compared to the increase in the electricity tariff, followed by bottled gas, in the housing group. The transport group also followed the highs that impacted the index, with emphasis on increases in the prices of airline tickets and gasoline. The main impacts of the food group are the rise of tomatoes, potatoes and chicken. Red meat finally got a low this month (IBGE, 2021; AGENCIA BRASIL, 2021).

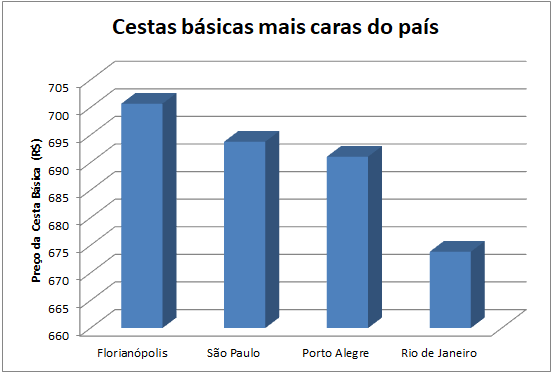

Food Parcel:

Source: DIEESE (2021)

Also considering the increases in food prices, Florianópolis was identified by the DIEESE monthly survey (2021) as having the highest basic food basket in October, reaching an expressive BRL 700.69, followed closely by São Paulo and Porto Alegre , with baskets of R$693.79 and R$691.08 respectively. To pay for the purchase of a food basket in Florianópolis, a family of four people (two adults and two children) would need to earn a minimum wage equal to R$ 5,886.50, that is, 5.35 times the value of the current minimum wage of BRL 1,100.00. In a survey carried out by the GPFA (2021), Florianópolis, Brasília, Salvador and Aracajú were the capitals where increases in the price of basic food baskets most quickly impact workers' future earnings. See full survey by CLICKING HERE.

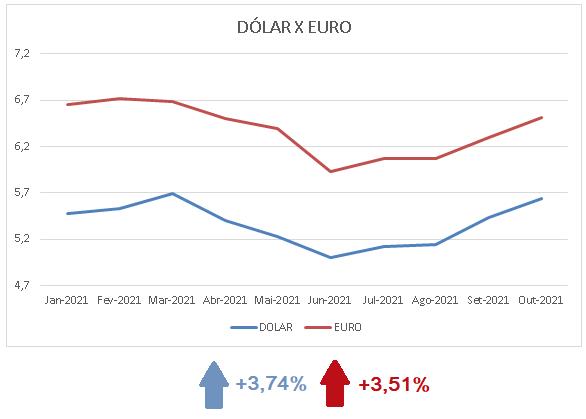

Exchange rates:

Source: Economatica (2021)

The Real continued its devaluation trajectory against the Dollar and the Euro in the month, with increases of 3.74% and 3.51% respectively.

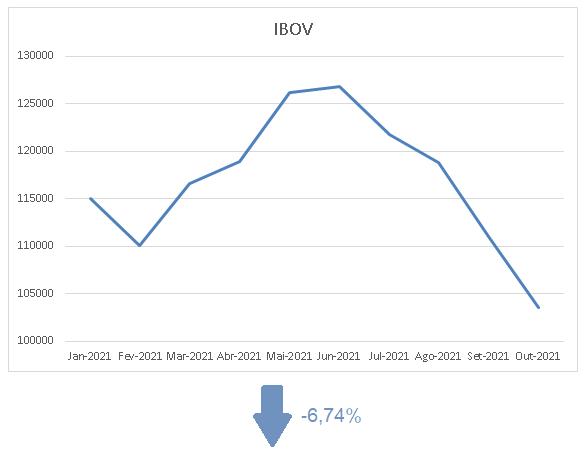

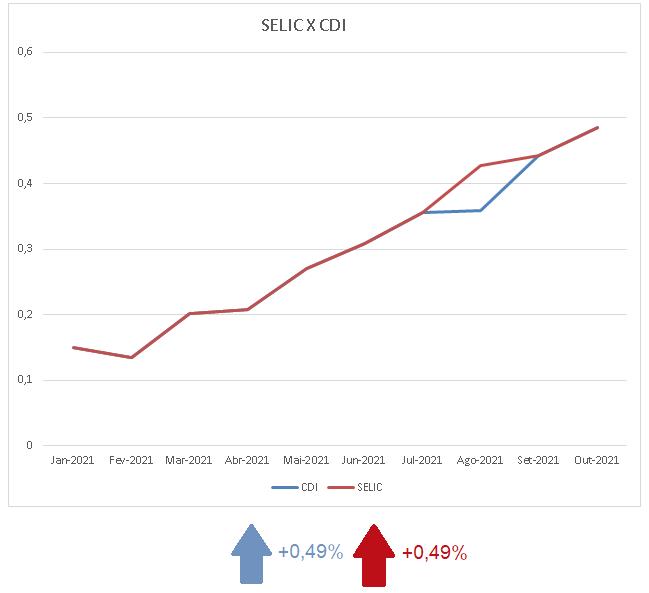

Variable Income and Fixed Income:

Source: Economatica (2021)

In yet another period of low IBOV in October, now accounting for -6.74%, the representative index of the Brazilian stock exchange has already accumulated a loss of 13% in the year, hitting 103,500 points. From the perspective of fixed income, the CDI, which adjusts the CDB rates and is pegged to the SELIC, accumulates gains of 2.91% in 2021. Would a new wave of fixed income investments be starting to form???! !

References

AGÊNCIA BRASIL. Prévia da inflação fica em 1,20% em outubro. Available in: https://agenciabrasil.ebc.com.br/economia/noticia/2021-10/previa-da-inflacao-ficou-em-120-em-outubro. Access 03 nov. 2021.

DIEESE. Em outubro, custo da cesta aumenta em 16 cidades. Available in: https://www.dieese.org.br/analisecestabasica/2021/202110cestabasica.pdf. Access: 05 nov. 2021.

FGV. IGP-M cai 0,64% em setembro de 2021. Available in: https://portal.fgv.br/noticias/igpm-setembro-2021. Access 03 nov. 2021.

ECONOMATICA. Plataforma financeira. Available in: https://economatica.com/plataforma-financeira. Access 03 nov. 2021.

GPFA. Cesta básica e rendimentos dos trabalhadores nas capitais brasileiras: uma análise da defasagem de sua transmissão. Available in: https://www.gpfa.com.br/informes-cient%C3%ADficos/cesta-b%C3%A1sica-e-rendimentos-dos-trabalhadores-nas-capitais-brasileiras-uma-an%C3%A1lise-da-defasagem-de-sua-transmiss%C3%A3o. Access: 05 nov. 2021.

IBGE. IPCA-15 - Índice Nacional de Preços ao Consumidor Amplo 15: Principais resultados - Outubro 2021. Available in: https://www.ibge.gov.br/estatisticas/economicas/precos-e-custos/9260-indice-nacional-de-precos-ao-consumidor-amplo-15.html?=&t=destaques. Access 03 nov. 2021.